I’ve added insurance here rather than in a separate step because I believe insurance is part of the planning process. Now that you know your risks, ask yourself if your existing insurance policies cover you for damages due to those risks. You can get insurance for many hazards such as fire, flood, and earthquake. If you are not sure of what is available, you can contact an insurance agent.

If you are fully covered already, that’s great. But if not, it might be a good idea to at least get a quote for insurance for each hazard because getting a quote is usually free. Then you can weigh your risk with your budget. Where we live, earthquake risk is not so great, so for us it isn’t worth the hit to our budget. We’ve also purchased a home that is not at risk of flooding from either being in the flood plain or from an isolated flooding problem. My real estate agent could tell you the lengths we went to make sure of that. But if you live in an area that does experience or has a risk for these hazards, having insurance will help you recover faster and more fully should you experience an event. Also if you cannot afford the cost of flood insurance for the full replacement value of your home, you can always ask for a quote for a lesser amount. The reason for this is that in the case of a flood at least having some insurance is better than none.

The threat of a fire and earthquake and even flooding if you are in a floodplain make sense to people. But I noticed when I was working for local government that people didn’t always realize they could be flooded even if they didn’t live in a flood plain. If you want to find out about your flood risk, you can always ask your local government personnel if your area is at risk of flooding or has flooded in the past. If so, you can still buy flood insurance through the National Flood Insurance Program (NFIP) even if you are not in the flood plain as long as your community participates in the NFIP. If you are not in the flood plain, the insurance through NFIP is typically at a much reduced price since you are not in the designated special flood hazard area. To get an idea of the damages you could experience due to water in your home, you can use this tool on the Floodsmart.gov website.

Also, if your community participates in the Community Rating System, you can receive a discount on your flood insurance based on their rating. The reduction, according to the Federal Emergency Management Agency (FEMA) which administers the program, is: “For CRS participating communities, flood insurance premium rates are discounted in increments of 5 percent (i.e., a Class 1 community would receive a 45 percent premium discount, while a Class 9 community would receive a 5 percent discount). A Class 10 is not participating in the CRS and receives no discount.”

Finally, here’s some additional information about insurance from the Ready.gov site:Â Document and Insure Your Property.

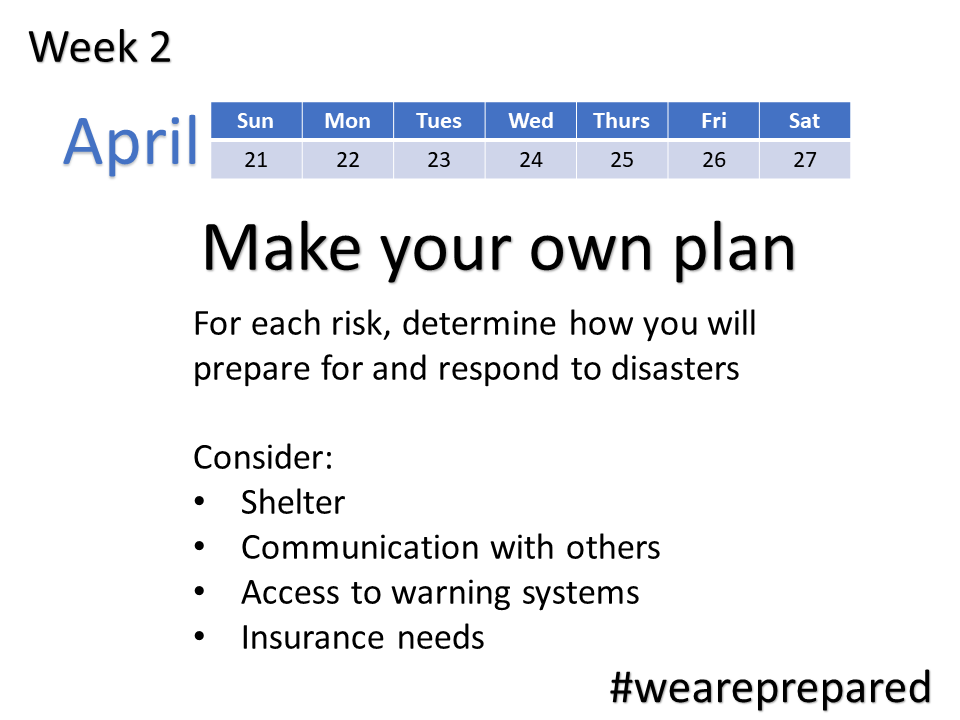

So for today, the step was to review your insurance coverage and consider if you have coverage for your risks. And if you are not already insured for those risks, balance the needs of your budget with the cost of the insurance and risk to decide if you should get insurance or not for that risk.

Thankfully for this step, and for our budget, we would not need additional insurance.

As a side note, throughout this series of posts about getting prepared, I may mention certain products, services, agencies, etc. At no time is it my intention to promote a specific product or service or agency. Each is mentioned only for informational purposes. Of course as a government employee, I do receive a salary from the government for the time I work on my job, but I don’t receive any compensation from any commercial entities I mention or include in these posts.